Global Economic Review, 44, 4: 452-469

This article is co-authored with Vito Amendolagine and Claudio Cozza

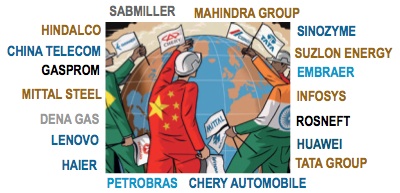

We study Chinese and Indian multinationals investing in Europe investigating their identity, their characteristics and the association between their features and their international strategies. In relation to the mode of entry, we find that greenfield investments are a more likely option for large-sized companies. Moreover a high propensity for innovation is associated with a high probability to enter with an acquisition and with technological asset-seeking investments.