Corriere della Sera on Investing in Women

Corriere della Sera has reported about “Investing in women: what women-led businesses in Italy and the UK need”. Here is the article.

in Articles, Media Tags: Credit, Gender, Small and Medium Enterprises

Corriere della Sera has reported about “Investing in women: what women-led businesses in Italy and the UK need”. Here is the article.

in Articles, Media Tags: Credit, Gender, Small and Medium Enterprises

in Articles, Media Tags: Credit, Gender, Small and Medium Enterprises

Il Blog Leadershipfemminile.com reported about “Investing in women: what women-led businesses in Italy and the UK need”. Here is the article.

in Featured Presentations, Presentations Tags: Credit, gender gap, Italy, UK, Women enterprises

On January 22nd I have presented the report Investing in women: what women-led businesses in Italy and the UK need, written in collaboration with Paola Subacchi and funded by the UK Embassy in Rome.

The report can be downloaded here

The slides (in Italian) can be downloaded here.

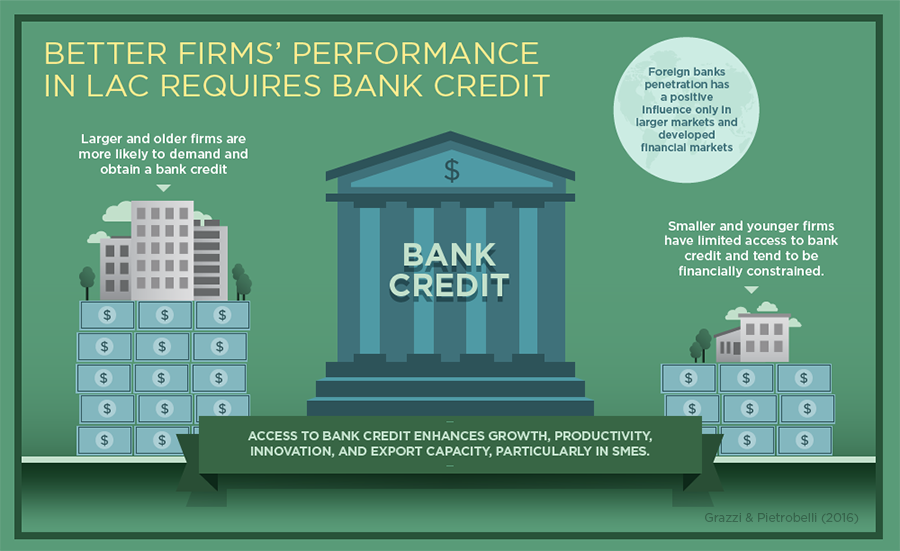

in Featured Publications, Journal Articles, Publications Tags: Credit, Latin America, Small and Medium Enterprises

A chapter co-authored with Andrea Presbitero on firm access to bank credit in Latin America was published in Firm Innovation and Productivity in Latin America and the Caribbean: The Engine of Economic Development edited by Matteo Grazzi and Carlo Pietrobelli. The paper is also published in Economic Notes.

The complete book can be downloaded here and our chapter is here

in Publications, Working Papers Tags: Access to credit, Credit, Latin America, Small and Medium Enterprises

An intense process of deregulation and financial liberalization in Latin America has increased competitive pressures and led to bank restructuring and consolidation. This paper looks at firm access to credit in the region, focusing on the role of credit market structure. Using firm-level data from theWorld Bank Enterprise Survey, we find that access to bank credit is very heterogeneous. On average, smaller and less productive firms are less likely to apply for credit and more likely to be financially constrained.

in Featured Publications, Journal Articles, Publications Tags: Credit, Gender, Small and Medium Enterprises

The literature on gender-based discrimination in credit markets is recently expanding but the results are not yet definitive. This paper exploits a new dataset on Barbados, Jamaica and Trinidad and Tobago and finds that more precise measures of the gender composition of the firm show that women-led businesses are more likely to be financially constrained than other comparable firms.

in Featured Presentations, Presentations Tags: Credit, Latin America, Small and Medium Enterprises

A paper on access to bank credit as one of the main constraints impairing firms’ growth, productivity, innovation, and export capacity has been presented at the seminar on Determinants of Firm Performance in LAC: What Does the Micro Evidence Tell Us?

Download the pdf Pres IADB 2014-06

in Journal Articles, Publications Tags: Colombia, Credit, Microcredit

Recent years have seen an intense and critical debate about the impact of microcredit on entrepreneurial activities and poor households’ welfare. This paper suggests that information asymmetries in the ex-post loan arrangement between the micro_nance institution (MFI) and local borrowers could partially explain the limited impact of microcredit. The physical distance separating borrowers from the MFI could be considered as a proxy of agency costs, increasing the costs of monitoring and easing moral hazard. The estimation of the e_ect of distance on the borrower’s self-assessed outcome of a microcredit project in Colombia con_rms the presence of moral hazard in the microcredit market, with agency costs increasing with geographical distance.

in Publications, Working Papers Tags: Credit, Gender, Small and Medium Enterprises

The literature on gender-based discrimination in credit markets is recently expanding but the results are not yet definitive and have not been generally agreed upon. This paper exploits a new dataset on Barbados, Jamaica and Trinidad and Tobago, which provides detailed information about female ownership and management in firms for investigating the existence of a gender gap in access to finance. The evidence presented herein suggests that more precise measures of the gender composition of the firm show that women-led businesses are more likely to be financially constrained than other comparable firms.

Download the pdf, WP IADB 2013-10