Città globali per gli investimenti delle multinazionali indiane

A short article written for lavoce.info written in collaboration with Vito Amendolagine and Lucia Piscitello is available here.

in Articles, Media Tags: FDI, Global Cities, India, Innovation, Multinationals

A short article written for lavoce.info written in collaboration with Vito Amendolagine and Lucia Piscitello is available here.

in Media Tags: China, Cross-border acquisitions, Foreign Direct Investments, India, Innovation, Multinationals

The article on Journal of Economic Geography with Amendolagine, Giuliani and Martinelli is featured in VoxChina.org.

in Featured Publications, Journal Articles Tags: China, Cross-border acquisitions, Foreign Direct Investments, India, Innovation, Multinationals

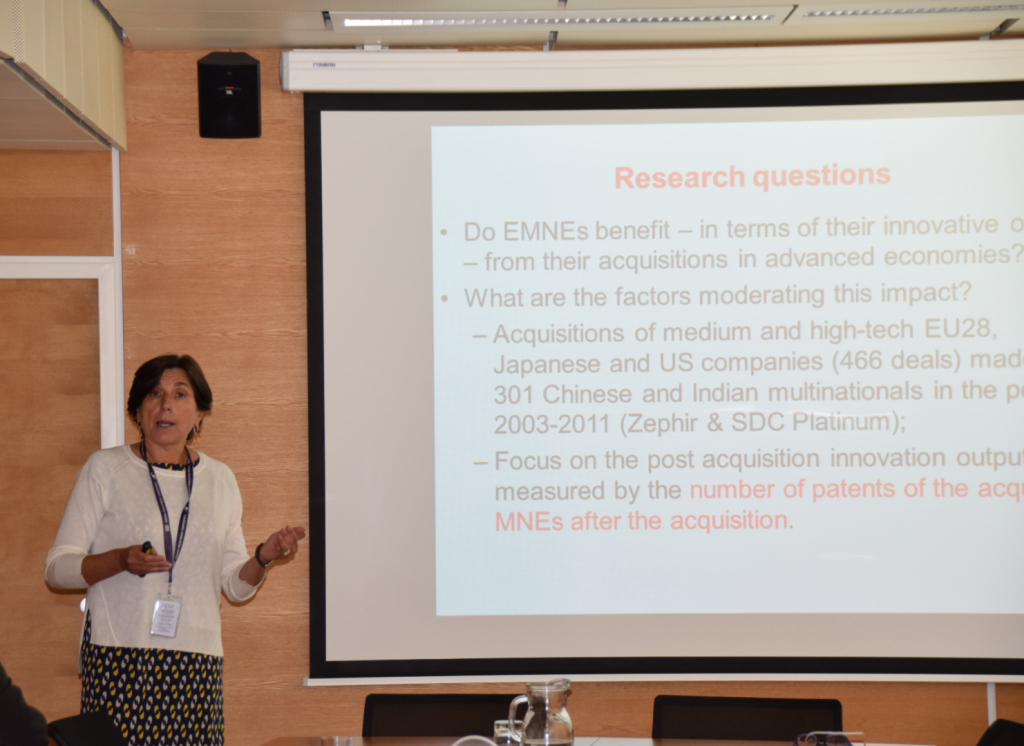

Chinese and Indian multinationals are continuously expanding their operations in Europe and the USA through cross-border acquisitions (CBAs), with the aim of tapping into international knowledge located in target firms and innovative hubs. In this article published in the Journal of Economic Geography with Amendolagine, Giuliani and Martinelli, we look into the innovative impacts that CBAs have on the acquiring multinational enterprises.

Here you can download the paper

in Featured Presentations, Presentations Tags: China, Emerging Countries, Emerging Countries Multinationals, India, Innovation, Italy, MNEs, Multinationals

On April I was invited at JRC in Seville to give a seminar. Here you can download the slides.

in Featured Presentations, Presentations Tags: China, Emerging Countries, India, MNEs

On 17th March I gave a seminar at IKE Innovation, Knowledge and Economic Dynamics Research Group – Aalborg University. The paper was previously presented also at the SIEPI Conference in Palermo, at GREDEG in Nice, at CICALICS Workshop in Beijing, at the 10th China Goes Global Conference in Macerata, at the workshop “Creating Leading Edge Technical Competencies in Chinese Companies – Innovation and Globalization” at the University of Gothenburg and at UNUMerit in Maastricht.

in Featured Publications, Journal Articles Tags: China, FDI, India, MNEs

We study Chinese and Indian multinationals investing in Europe investigating their identity, their characteristics and the association between their features and their international strategies. In relation to the mode of entry, we find that greenfield investments are a more likely option for large-sized companies. Moreover a high propensity for innovation is associated with a high probability to enter with an acquisition and with technological asset-seeking investments.

in Featured Presentations, Presentations Tags: Catch up, China, India, Innovation, Patents

On 22h October 2015 I presented a paper at the IB Research Seminar Series

in Featured Publications, Journal Articles Tags: Brazil, Catch up, China, India, Innovation, Patents

Growing internationalization constitutes an opportunity for technological catch up. In this paper we analyze Brazilian, Indian, and Chinese cross-border inventions with EU-27 inventors. Our results suggest that these inventions represent an opportunity for emerging country firms to accumulate technological capabilities, access frontier knowledge, and appropriate the property rights of co-inventions.

in Featured Publications, Publications, Working Papers Tags: China, Emerging Countries, Europe, FDI, India, MNEs

This paper looks at the location choices of MNEs in the European Union (EU-25) regions and unveils that EMNEs follow distinctive location strategies. Their attraction into large regional markets is similar to AMNEs as well as their irresponsiveness to efficiency seeking motives. Conversely, the most knowledge-intensive investments respond mainly to strategic assets and the agglomeration of foreign investments in the same business functions.

in Featured Publications, Working Papers Tags: China, Emerging Countries, FDI, India

In this paper we undertake an empirical analysis of Chinese and Indian FDIs in Europe to investigate their identity and characteristics and the association between these features and their international business strategies. We exploit a dataset at the level of the investing firms. In relation to mode of entry, we find that the greenfield is a more likely option for large-sized companies, and that weak propensity for innovation is associated with a low probability to enter through a merger or acquisition. A high propensity for innovation is related to asset-seeking FDI, while high profitability is needed to invest in the core EU countries.

in Articles, Media Tags: China, Europe, FDI, India, MNEs

With Alessia Amighini and Claudio Cozza I wrote an article on emerging multinationals investing in Europe. Tito Boeri wrote about this article in Internazionale.

in Publications, Working Papers Tags: China, FDI, India

The present paper is about the ownership choices by Emerging Market Multinational Enterprises (EMNEs) when they invest in Europe through M&As, and the relationship with the main motivations underlying their international expansion. Namely, we claim that EMNEs prefer to acquire less control and keep the local partner when they invest for seeking knowledge. Additionally, EMNEs choose partial acquisitions in case of high dissimilarity in terms of culture, industry and knowledge base.

Our empirical analysis relies on a dataset of M&As undertaken by Chinese and Indian MNEs in high and medium-high tech sectors, in the period 2003-2011. We use content analysis of public announcements and company reports for classifying the main motivation of the acquisitions, and econometric analysis for testing our hypotheses. Our results confirm the expectations.