Technology-Driven FDI by Emerging Multinationals in Europe – School of Business D’Amore McKim – Northeastern University

On September 9th I gave a talk at Nardone Family Seminar Series at the Center for Emerging Markets – NEU in Boston.

in Featured Presentations, Presentations Tags: Emerging Countries, Innovation, MNEs

On September 9th I gave a talk at Nardone Family Seminar Series at the Center for Emerging Markets – NEU in Boston.

in Featured Publications, Journal Articles, Publications Tags: Emerging Countries, FDI, MNEs

The phenomenon of Emerging Economy Multinational Enterprises (EMNEs) and their internationalization process have sparked the debate over the appropriateness of International Business theories to study EMNEs’ internationalization processes. The literature has extensively investigated what distinguishes EMNEs from Advanced Country Multinational Enterprises (AMNEs). This review summarizes and discusses some of the issues that have mostly attracted scholarly debate in this research area.

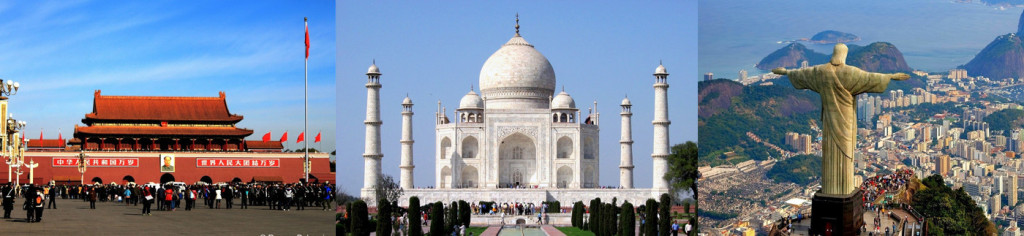

in Featured Publications, Publications, Working Papers Tags: China, Emerging Countries, Europe, FDI, India, MNEs

This paper looks at the location choices of MNEs in the European Union (EU-25) regions and unveils that EMNEs follow distinctive location strategies. Their attraction into large regional markets is similar to AMNEs as well as their irresponsiveness to efficiency seeking motives. Conversely, the most knowledge-intensive investments respond mainly to strategic assets and the agglomeration of foreign investments in the same business functions.

in Presentations Tags: Emerging Countries, FDI, MNEs

in Articles, Media Tags: Emerging Countries, Innovation, MNEs

A paper by Rabellotti, together with Giuliani, Gorgoni and Guenther, was reviewed in the Rising Powers Blog.

in Featured Publications, Journal Articles, Publications Tags: Emerging Countries, Innovation, Local Development, MNEs

It empirically investigates how subsidiaries of multinationals from both emerging (EMNEs) and advanced (AMNEs) economies investing in Europe learn from the local context and contribute to it as much as they benefit from it. To explore this we classify the behavior of MNE subsidiaries into different typologies on the basis of how knowledge is transferred within the multinational and on the nature of the local innovative connections. The empirical analysis relies on an entirely new, subsidiary-level dataset in the industrial machinery sector in Italy and Germany. Results show that EMNEs and AMNEs undertake different strategies for tapping into local knowledge and for transferring it within the company. We identify a new typology of EMNE subsidiary that contributes through its significant local innovative efforts to development processes in the host country. This result suggests possible win-win situations from which novel policy implications may be drawn.

The article has been reviewed in the Rising Powers Blog.

in Articles, Media Tags: China, Europe, FDI, India, MNEs

With Alessia Amighini and Claudio Cozza I wrote an article on emerging multinationals investing in Europe. Tito Boeri wrote about this article in Internazionale.

in Publications, Working Papers Tags: China, FDI, MNEs

The empirical literature on China’s outward foreign direct investment (OFDI) mainly relies on aggregate data from official statistics, whose international reliability is currently a matter of concern, not taking account some relevant features such as the industry breakdowns, ownership structures and modes of entry. A novel firm-level database – EMENDATA – compiled by matching data from several available sources, on various types of cross-border deals, and including information on group structure, enables new empirical analyses and provides new insights into the rapidly increasing presence of Chinese companies abroad. In this paper, exploring the potential of this database we offer an informative and comprehensive assessment of the geographical and specialization patterns of Chinese outward FDI into Europe and suggest new avenues for further research on this highly policy relevant issue.

in Journal Articles, Publications Tags: Europe, Global Value Chain, Innovation, MNEs

It investigates the geography of multinational companies’ investments in the EU regions. The ‘traditional’ sources of location advantages (i.e. agglomeration economies, market access and labour market conditions) are considered together with innovation and socio-institutional drivers of investments, captured by means of regional “social filter” conditions. This makes it possible to empirically assess the different role played by such advantages in the location decision of investments at different stages of the value chain and disentangle the differential role of national vs. regional factors. The empirical analysis covers the EU-25 regions and suggests that regional socio- economic conditions are crucially important for the location decisions of investments in the most sophisticated knowledge-intensive stages of the value chain.

in Articles, Media Tags: China, Europe, FDI, MNEs

On the Blog EyesReg with Marco Sanfilippo, I wrote about multinationals from emerging countries investing in Europe.

in Journal Articles, Publications Tags: Emerging Countries, FDI, MNEs

One of the more recent aspects of the globalization process is the rise and the increasing outward expansion of multinational enterprises (MNEs) from developing countries. Among the more promising effects of this phenomenon is a potentially positive development impact: through outward foreign direct investment (OFDI) developing country MNEs acquire new knowledge, which contributes to the technological catch-up of their home countries. This paper reviews the recent literature on OFDI from developing countries, with a critical focus on the theory and evidence of FDI as a channel for technological catch-up. This literature suggests that the features and global business environment of current emerging country MNEs is different from those of latecomer firms in earlier decades. Modularity of production in an increasing number of sectors, combined with weak national innovation systems (NIS) in many developing countries explain why the sourcing of strategic assets – including technology and innovation – from abroad through OFDI has become such an important channel for technological catch-up.